Managing Unclaimed Property For Common Retail Bank Accounts

Retail banks have a few common property types that share unclaimed property headaches. Some are easier than others but all require a good set of policies and procedures to properly track the aging of the accounts. The common types to look at are:

Checking Accounts

Savings Accounts

Certificate of Deposits (CD’s)

Checking/Savings Accounts

Checking/Savings accounts are aged based on the last owner-directed activity or last owner contact date of the account. Once these accounts age 3 to 5 years, they will need to follow the same protocols as used for all other property types and receive a due diligence communication to attempt to locate the owner prior to escheatment. Many banks set policies to ensure property contact is being established and in some cases, they even close the account and issue a check if a certain period of time passes. The escheatment itself would only have an additional requirement if it was an interest-bearing account. In this case, the rate would need to be included in the file going to the state as some states require accrued interest to be paid out on claims.

Certificates of Deposit (CD’s)

CDs are one of the more complex assets to manage when determining the dormancy for unclaimed property. Most investors have no idea that investing in a CD could result in their property being turned over to the state, especially when they opt for the auto-renew feature, or via bank policy if they don’t respond to bank notice/statement regarding the upcoming maturity. This allows their CD to roll into a new period if they take no action; however, the inactivity after the first maturity date is the trigger for many state unclaimed property regulations. Some states let the CD mature twice before escheating.

Let’s look at two examples of the ways CD’s age according to certain state statutes as this will highlight the variances in the law.

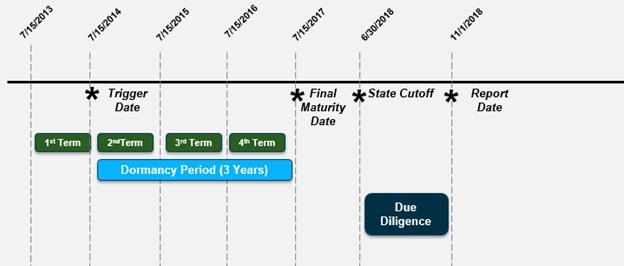

Example 1: John Smith, no contact in a 3-year dormancy state after the first maturity, who has a 1 year auto renewing CD purchased on 7/15/2013. The trigger date would be the day the first term of the CD expires, which is 7/15/2014. That would be the date the account was aged if no other contact has occurred. So this account would go through a 4th term and be escheated.

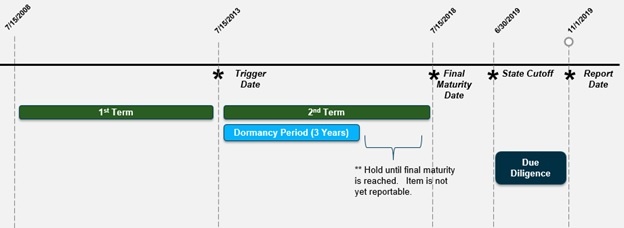

Example 2: John Smith, no contact in a 3-year dormancy state after the first maturity, who has a 5 year auto renewing CD purchased on 7/15/2008. The trigger date would be the day the first term of the CD expires, which is 7/15/2013. This time you can see the CD is still outstanding when the dormancy period expires of the second term. Technically, the states would allow the holder to leave the account open until the 2nd maturity expires but many banks choose to report when it reaches dormancy, waiving any fees associated with early termination. (This is how some savvy investors can avoid fees!)

Due to the nature of the industry, retail banks are tasked with managing many different types of property; and some are much more complex than others. This means staff will need to invest time to monitor statutes, maintain records, manage calls & letters, deal with fraud, and submit escheat reports. Implementing a system and strong policies will assist with ensuring unclaimed property compliance is on track. Here are a few steps to consider when creating your procedures:

- Identify inactive accounts before they become escheatable property

- Establish a strong customer contact program

- Collect more than one contact number/address for customers

- Build a formal process for comprehensive information gathering

- Train all departments to identify potential unclaimed property

It’s important to know where your unclaimed property is generated and what condition data is in, so you can anticipate what it will take to get your processes where they need to be. A professional risk assessment can help you determine any potential exposure or gaps in your process.

If you received a letter or an email, please check out our FAQ section to learn more about next steps.

We offer a customized approach to fit your specific needs.