State Unclaimed Property Notices – Best Practices

C-Suite individuals receive a plethora of important mailings, many of which pertain to certain compliance requirements for the company. Understanding and being familiar with the type of mailing received is important. If handled improperly, unclaimed property notices may result in increased risk for the company.

C-Suite individuals receive a plethora of important mailings, many of which pertain to certain compliance requirements for the company. Understanding and being familiar with the type of mailing received is important. If handled improperly, unclaimed property notices may result in increased risk for the company.

This article provides an overview of unclaimed property, the types of unclaimed property notices received by companies, and best practice recommendations on how to handle such notices.

UNCLAIMED PROPERTY BASICS

All 50 states, together with the District of Columbia, Guam, Puerto Rico, and the Virgin Islands, have unclaimed or abandoned property laws. For further information on unclaimed property basics, including key terms, please refer to the Journal of Accountancy article Unclaimed Property: What is it, and what are the risks?.

UNCLAIMED PROPERTY BASICS

All 50 states, together with the District of Columbia, Guam, Puerto Rico, and the Virgin Islands, have unclaimed or abandoned property laws. These laws govern the disposition of unclaimed property, under which the states serve as custodians of the property on behalf of the rightful owner (a process typically referred to as escheatment). Unclaimed property can be tangible (safe deposit box contents) or intangible property (securities-related property and general ledger property) that is due and owing to a third party (the owner) where there has been no contact with the owner for a specific period of time (dormancy period).

Once the dormancy period has elapsed, the entity legally responsible for the obligation to the owner (the holder) is required to perform statutory due diligence in an attempt to locate the owner of the abandoned property prior to escheatment. The holder is required to:

- Confirm the owner’s interest in property that meets the states’ varying dollar thresholds by sending the owner notice via a due diligence letter or email. Certain jurisdictions may also have certified mail requirements, or advertising requirements, such as newspaper publication, for property over a certain threshold or for certain property types.

- If the owner fails to respond to the notice, the holder must then escheat the property to the appropriate jurisdiction. Property is then held by the state in custody for the owner until the owner comes forward to claim it.

Determining the appropriate jurisdiction to escheat the property is based on the priority rules first established in a 1965 United States Supreme Court case, Texas v. New Jersey, 379 U.S. 674 (1965). Under the first priority rule, the property escheats to the state of the owner/payee’s last known address, per the books and records of the holder. Under the second priority rule, property escheats to the state of the holder’s domicile/incorporation if the owner/payee’s address is unknown.

STATE UNCLAIMED PROPERTY NOTICES

States have typically adopted a version of the model Uniform Unclaimed Property Acts from 1981, 1995, or 2016. Under each of these acts, states are provided with the statutory authority to examine a company’s books and records to verify abandoned property compliance. To this end, each state may employ its own methodology to verify a holder’s compliance.

At a high-level, the unclaimed property notice received from the state will come in one of three forms.

- Annual Compliance Reminder

- Notice of Examination

- Amnesty Program Invitation / Self-Audit

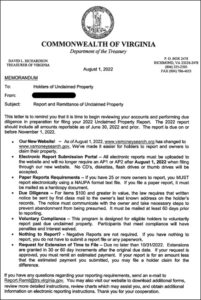

Annual Compliance Reminder

State unclaimed property reporting deadlines vary by state and generally fall into three reporting cycles (Spring, Summer, and Fall). States will often mail a reminder letter to file unclaimed property reports to the holder in the months leading up to the annual reporting deadlines. Below is an example from Virginia which was sent in advance of their November 1, 2022 reporting deadline. Filers should pay particular attention to any changes in the reporting process referenced in the letter by the state, which in the case below, indicates a change in the website where companies should upload reports when reporting to Virginia. Additional considerations that are often included in such reminder letters may include:

- Any recent law changes (to filing dates, dormancy periods, etc.)

- How and where to submit the report

- Due diligence requirements

- Remittance requirements and payment type threshold, as applicable

- Tangible property requirements

- Securities transfer instructions

- Negative reporting requirements

- Filing extension procedures

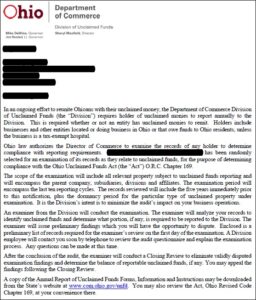

Notice of Examination

Escheat compliance is not optional and because the states have the authority to audit the books and records of the holder to determine compliance, whether an audit is forthcoming is best described as a matter of when, and not if.

States often have specific criteria and identification techniques, including the use of third-party auditor software, to determine targets for examination. This software enables the states to determine the property types that have been filed by the holder and additional property types that they believe “should” have been or “should be” filed as unclaimed property. Additionally, common red flags include missed or irregular report filings by the holder, inconsistencies in the amount of property reported, or irregularities in the property types reported. The states may also review the company’s filing history against those of other entities in the same industry to identify non-compliance.

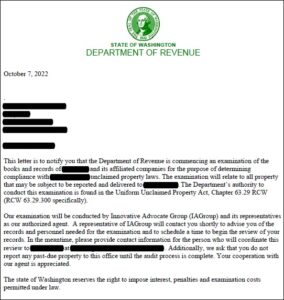

Examinations are typically conducted by a state representative or a third-party auditor. The first graphic below from the Ohio Department of Commerce provides an example of an audit conducted by the state, whereas the second and third notices provide examples of an audit conducted by a third-party auditor on behalf of the state, Innovative Advocate Group (IA Group) on behalf of Washington, and Kelmar Associates, LLC (Kelmar) on behalf of Delaware, respectively. Companies should read the letter carefully if a notice of examination is received from a state.

Important pieces of information to be aware of in audit notices include:

- The scope of the examination, including the entities, types of property, and years under examination.

- Whether a state official or a third-party auditor will be conducting the examination.

- Whether statutory penalties and interest may be imposed.

- What, if any, further action may need to be taken by the holder (e.g., do not report past due property until the audit is complete).

Audits conducted by the state are generally not as stringent as an examination conducted by a third-party auditor. Third-party auditors maintain many state relationships, and it is likely that if one audit notice is received, then other state audit notices are on the way.

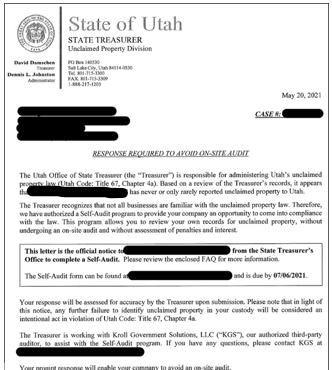

Amnesty Program Invitation / Self-Audit

Prior to conducting a full examination, many states allow companies the opportunity to conduct a self-review to verify compliance. Interestingly, many of the state self-reviews are guided by one of the state’s third-party auditors. As one can imagine, any responses provided in such a review should not be taken lightly, as the response has the potential to lead to a full examination.

The notice below from the State of Utah is an example of such a communication, where the self-audit is to be conducted by the state and liaised by a third-party auditor. Companies should take note of any response deadline indicated in the notice to reduce additional risk.

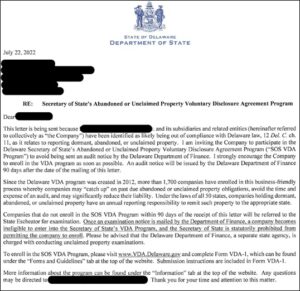

Delaware, which is arguably the most active state when it comes to unclaimed property compliance enforcement, routinely sends Voluntary Disclosure Agreement (“VDA”) invitations, Verified Report, and Compliance Review mailings.

The notice below is an example of an invitation to enter the state’s VDA program. Should the company fail to enter the VDA program within 90 days, the company “will be referred to the State Escheator for examination.” Performing a Delaware VDA has several distinct benefits compared to undergoing a Delaware examination, a few of which are listed below.

- The work is driven by the company versus the auditor.

- The testing procedures under the VDA program are less stringent than those under an audit. (e.g., checks voided 90 or more days after issuance are reviewed in the VDA program, while under an audit, checks voided 30 or more days after issuance are reviewed).

- The company is allowed a waiver of penalties and interest (which, under an audit scenario can be significant).

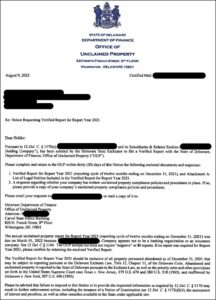

Verified Reports and Compliance Reviews sent by Delaware are notices targeted at current filers of unclaimed property that have either failed to file a report for a given report year or otherwise appear to be out of compliance. As detailed in the sample Verified Report notice below, if a company fails to respond to the notice within the timeframe provided therein, Delaware may issue a Notice of Examination.

MAINTAIN COMPLIANCE

Nearly every company can generate unclaimed property. Companies with comprehensive unclaimed property compliance programs minimize their liabilities and lower their risk of audit. Regularly performing self-audits or risk assessments to locate missed or underreported property assist in early detection and remediation efforts. Companies may also perform off-cycle reports for missed property types or where unclaimed property filings have been inconsistent. Lastly, companies should have robust policies and procedures to help identify, track, and document their unclaimed property efforts.

To obtain more information on state reporting requirements or to search for unclaimed property, readers can visit unclaimed.org.

About the author

Luke A. Sims, CPA, is a partner and advisory practice leader at MarketSphere Consulting, LLC in Overland Park, Kansas. MarketSphere Group LLC is not an accounting or law firm, and the information provided within this article should not be viewed as accounting or legal advice.

IN BRIEF

- The requirements imposed by unclaimed property statutes vary by state.

- States mail a variety of unclaimed property notices.

- CPAs should understand best practices on how to handle notices received.

- Companies should employ proactive measures to maintain escheat compliance.

This article originally appeared in The Journal of Accountancy. ©2023 Association of International Certified Professional Accountants. All rights reserved. Used by permission.

*Content contained in this article is considered accurate as of the publish date.

If you received a letter or an email, please check out our FAQ section to learn more about next steps.

We offer a customized approach to fit your specific needs.